Expense Documentation for Divorce, Custody, and Taxes

Find out how to collect and organize reliable expense documentation for your child custody case and tax purposes.

Find out how to collect and organize reliable expense documentation for your child custody case and tax purposes.

When you’re facing a divorce or custody dispute, keeping detailed records of child-related expenses is one of the most important steps you can take. Good documentation can strengthen your legal position and ensure that you receive or provide the proper financial support for your child.

Certain expenses tracked for custody purposes may also help you at tax time. Using the same expense tracking system for both custody and tax purposes offers two major benefits: you avoid duplicating effort, and you make it much easier to find supporting documents if the IRS ever requests them.

When calculating child support, courts look at many factors to ensure the child’s needs are met. These include each parent’s income, the number of children, the time-sharing arrangement, and additional costs such as child care or health insurance. One crucial element is documented child-related expenses—concrete proof of costs like medical bills or daycare fees.

Below you’ll find a practical overview of key expense categories and sample documentation that courts and professionals recommend tracking for child support purposes. Use this table as a checklist or reference when gathering your own records.

| Category | Examples |

|---|---|

| Housing, Food & Clothing |

|

| Medical Care & Insurance |

|

| Child Care |

|

| Educational Fees |

|

| Extracurricular & Social Activities |

|

| Transportation |

|

| Holiday Trips & Vacations |

|

Other Items Worth Tracking:

When a child support order is being determined for the first time (for example, during a divorce or separation proceeding), that’s the time to ensure all relevant expenses are presented to the court.

In the U.S., the standard guideline formula (a formula set by state law, based primarily on parents’ incomes, custody time, and number of children) will be the starting point, but most guidelines allow additions or deviations for certain documented costs.

Here’s how documented expenses can affect an initial order:

In summary, at the time of the initial child support order, bring all relevant documentation: receipts, bills, invoices, contracts, proof of payment. Courts consider a wide range of factors – including these documented expenses – to ensure the support order is fair and sufficient.

Child support isn’t set in stone – as life goes on, orders can be modified if circumstances change significantly. A common reason for modification is a change in financial circumstances or expenses related to the child. Here’s how documented expenses come into play when adjusting support after the initial order:

In all modification scenarios, documentation is your evidence. Courts need objective proof of changes – simply saying "I spend a lot more on the kids now" or "my ex is making more money" is not enough. Save receipts, bills, pay stubs, and written agreements. These records let you avoid "he said/she said" situations if your case returns to court.

Below are some examples of questions you might be asked in court or during negotiations. Being prepared for these will help you present your case more confidently and effectively.

To help you prepare evidence that will be accepted by the court, here are the most common types of supporting documents for custody-related expenses, along with the legal requirements each must meet:

| Document Type | Legal Requirements |

|---|---|

| Receipt |

|

| Invoice/Bill |

|

| Bank/Credit Card Statement |

|

| Canceled Check |

|

| Explanation of Benefits (EOB) |

|

| Contract/Agreement |

|

| Attendance Records |

|

| Photos/Scans of Documents |

|

Family law attorneys may attempt to dispute the credibility or relevance of expense records presented as evidence. Understanding these tactics helps you avoid common pitfalls:

Handling taxes as a single or divorced parent can be confusing, but understanding a few key points will help you document the right information and maximize your benefits. Below you will find the main U.S. tax regulations and considerations that are worth reviewing.

The IRS has its own rules about who can claim a child as a dependent and who can take certain tax credits. These rules don’t always match what the custody court ordered.

Typically, the custodial parent—the parent with whom the child spends more nights during the year—claims the child for tax purposes, unless a signed IRS Form 8332 or other agreement lets the noncustodial parent claim them instead.

If you want to be recognized as the custodial parent, it’s important to keep accurate records of your parenting time, especially if your parenting plan provides for a close-to 50/50 split. Clear, dated documentation can help show that your child spent more nights with you, which may determine your eligibility to claim the child as a dependent.

For more information about who qualifies as a dependent child for tax purposes—including rules on age, residency, relationship, and support—see the relevant section in IRS Publication 501. This page explains all the requirements you need to meet to claim a child as your dependent.

Some U.S. tax benefits for parents require you to carefully track and document specific expenses, while others rely only on general eligibility or relationship. The table below summarizes the most common tax credits and deductions, showing which require detailed record-keeping. In the following sections, we focus on those credits and deductions that involve expense tracking, so you’ll know what to save and how to prepare.

| Benefit | Track Expenses? | What to Track / Prove If Needed |

|---|---|---|

| Head of Household (HOH) filing status | Yes | Proof you paid >50% of home upkeep (bills, rent, mortgage, etc.) |

| Child and Dependent Care Credit (CDCC) | Yes | Care expenses, provider info, payment proof |

| American Opportunity Credit (AOTC) | Yes | Tuition and required education expenses for your child’s first four years of college, Form 1098-T, receipts |

| Lifetime Learning Credit (LLC) | Yes | Tuition, required fees, required materials paid to the school, Form 1098-T, payment records |

| Medical and Dental Expense Deduction | Yes | Out-of-pocket medical and dental costs for you or your dependents, above 7.5% of AGI if you itemize. Save receipts and insurance records. |

| Self‑Employed Health Insurance Deduction | Yes | Premiums for medical, dental, and qualified long‑term care insurance for you and dependents. Save invoices and payment proof. |

| Earned Income Tax Credit (EITC) | No | Proof of earned income (W-2, 1099, pay stubs) |

| Child Tax Credit (CTC) | No | Child’s identity, relationship, and residency |

| Credit for Other Dependents (ODC) | No | Relationship & dependent status |

Head of Household (HOH) is a special filing status for unmarried parents who carry the main cost of running their home. It lets you pay less tax than the standard single filing status by giving you a larger standard deduction and lower tax rates.

To qualify as HOH, you must meet all three basic conditions:

Costs that do count toward “keeping up a home”:

Costs such as clothing, education, medical treatment, vacations, life insurance, and transportation do not count toward this test.

For official guidance, see the IRS Publication 501.

If you paid someone to take care of your child (under age 13) so that you could work or look for work, you may qualify for the Child and Dependent Care Credit. This credit is designed to offset a portion of daycare, after-school care, babysitters, or similar care expenses. To claim it, you must have earned income from a job or self-employment – it’s essentially a reward for working parents who incur childcare costs.

The credit covers a percentage of your care expenses, and the exact percentage depends on your income. Lower-income parents get a larger break (up to 35% of eligible expenses), while higher earners get a smaller break (down to 20% of expenses). For the 2024 tax year (returns filed in 2025), there is also a cap on the expenses you can count: you can include up to $3,000 of care expenses for one child, or up to $6,000 for two or more children.

| Examples of Child and Dependent Care Expenses | |

|---|---|

| Allowed |

|

| Not Allowed |

|

In complex cases—like boarding schools or programs that blend care and instruction—only the portion directly tied to care qualifies. Keep itemized receipts or a provider’s statement to support your claim.

Remember that you’ll need to list the care provider’s name, address, and taxpayer identification number (SSN or EIN) on your tax return to claim this credit. If the provider is a tax-exempt organization, only the name and address are required. If you are unable to obtain the number despite reasonable efforts, you may still qualify by documenting your attempt and attaching a statement to your return.

Always refer to the most recent guidance, as amounts and rules may change. For full details and worksheets, see IRS Publication 503.

If you pay for qualified higher education expenses for your child, you may qualify for the American Opportunity Credit (AOTC). This credit helps offset the cost of tuition and related education expenses during your child’s first four years of post-secondary education. It is available to you even if you are a single or divorced parent, as long as your child is your dependent and you meet the income requirements.

For the 2024 tax year (returns filed in 2025), the maximum credit is $2,500 per eligible student. You can claim 100% of the first $2,000 of qualified education expenses you paid, plus 25% of the next $2,000, per student. The AOTC is partially refundable: if the credit brings your tax liability to zero, you can receive up to 40% of any remaining amount as a refund (up to $1,000 per student).

The credit phases out for higher incomes; for the 2024 tax year, the ability to claim the full credit begins to phase out at a modified adjusted gross income (MAGI) of $80,000 for single filers, and is fully phased out at $90,000.

| Education Expenses for the American Opportunity Credit (AOTC) | |

|---|---|

| Qualified |

|

| Not Qualified |

|

To claim the AOTC, you must have paid expenses for an eligible student (your dependent child) pursuing a degree or recognized credential, enrolled at least half-time for part of the year, and not yet finished four years of higher education. You’ll need a Form 1098-T from the school and receipts for any qualified course materials bought elsewhere.

Always double-check the latest IRS guidance before you file, because dollar limits and income thresholds can change. For full details and current worksheets, see IRS American Opportunity Credit and Publication 970.

If you pay qualified education expenses for your dependent child, you may be able to claim the Lifetime Learning Credit (LLC). This credit helps with the cost of undergraduate, graduate, or professional degree courses—including courses to acquire or improve job skills—at an eligible educational institution. You can claim the LLC even if your child is only taking one course or is not pursuing a degree.

For the 2024 tax year (returns filed in 2025), the LLC is worth up to $2,000 per tax return, not per student. You can claim 20% of the first $10,000 in total qualified education expenses paid for all eligible students in your family. Qualified expenses include tuition and required fees, as well as course materials needed to enroll or attend (if paid directly to the institution).

For 2024, the credit is gradually reduced (phased out) if your modified adjusted gross income (MAGI) is between $80,000 and $90,000 for single filers. You cannot claim the credit if your MAGI is $90,000 or more.

| Education Expenses for the Lifetime Learning Credit (LLC) | |

|---|---|

| Qualified |

|

| Not Qualified |

|

You can claim the LLC for your child as many years as you qualify, but not for the same student in the same year as the American Opportunity Credit.

To claim the LLC, your dependent child must be enrolled at an eligible school, and you need to receive a Form 1098-T from the institution. Save this form and all records of your payments to support your claim.

As with other education credits, always check for IRS updates before filing, as rules and dollar limits may change. For full details, see IRS LLC page and IRS Publication 970.

While not a credit, you should be aware of the Medical and Dental Expense Deduction—especially if you face high out-of-pocket health costs for yourself or your children. If you itemize deductions (instead of taking the standard deduction), you may be able to deduct unreimbursed medical and dental expenses paid for yourself and your dependents, but only the portion that exceeds 7.5% of your adjusted gross income (AGI) for the year.

For the 2024 tax year (returns filed in 2025), you can deduct qualified medical and dental expenses that exceed 7.5% of your AGI. For example, if your AGI is $50,000, the first $3,750 of medical bills (7.5% of $50,000) do not count; but if you have $10,000 in qualified expenses, you could potentially deduct $6,250—the amount over $3,750.

| Medical and Dental Expenses for the Deduction | |

|---|---|

| Qualified |

|

| Not Qualified |

|

Two important notes:

This deduction can provide some relief in years when you’ve had extraordinary medical burdens, but for routine medical expenses most people won’t clear the 7.5% income hurdle.

For complete lists of allowed and disallowed expenses, see IRS Publication 502: Medical and Dental Expenses.

If you are self-employed and pay for your own health insurance, you may be able to deduct premiums for yourself, your child, and other dependents—even if you do not itemize deductions. This deduction is especially valuable for single and divorced parents who run a business or freelance.

For the 2024 tax year, you can deduct premiums paid for medical, dental, and qualified long-term care insurance for yourself, your dependents, and any children under 27 at the end of the year—even if the child is not your tax dependent. The deduction cannot exceed your net self-employment income, and you cannot claim it for any month you or your child were eligible for an employer-subsidized plan.

| What Insurance Premiums Can Be Deducted? | |

|---|---|

| Qualifies |

|

| Does Not Qualify |

|

Complete Form 7206 to figure the deduction, attach it to your return, and then report the result on Schedule 1 (Form 1040). You do not have to itemize to benefit.

For more information and the latest rules, see IRS Instructions for Form 7206.

Finally, remember that your state may offer its own tax credits or deductions for parents and dependents. Many states have a state-level Earned Income Credit or Child Tax Credit that is based on your federal EITC or CTC, often calculated as a percentage of the federal credit. Some states also provide credits for child care expenses, education savings, or other family-related costs. The rules and availability vary widely—for example, a state might offer a refundable credit for child care if you’re a resident.

Be sure to check your state’s revenue department website or tax instruction booklet for a section on credits or deductions for families and single parents. These local benefits can put extra money in your pocket on top of your federal tax breaks.

If you’re unsure, search for your state name plus “tax credits for parents” or contact your state tax agency for details. Federal IRS resources won’t list all state programs, so be sure to review your specific state’s offerings.

If you’re not sure how your custody situation affects your taxes, or if you and your co-parent share expenses or time equally, it’s wise to consult a tax professional familiar with family law. Unified expense tracking will give them (and you) everything needed to make the strongest, most accurate claim possible.

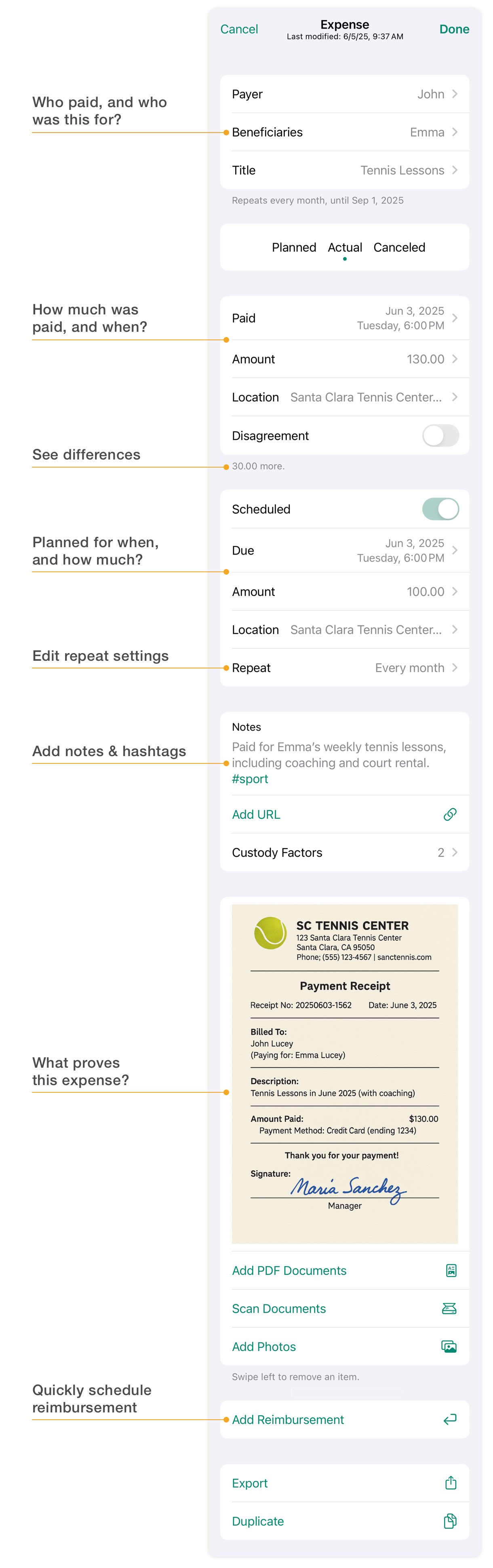

Alimentor was built specifically for parents who need clear, reliable records—whether you’re dealing with high-conflict custody, preparing for court, or organizing tax documents. Every feature helps you document, organize, and prove expenses with minimal hassle.

| Feature | How to Use for Documenting Expenses |

|---|---|

| Tracking | Log all child-related expenses—education, healthcare, activities, household costs, and more. Every entry becomes part of your complete financial record. |

| Planning | Plan upcoming recurring and one-time expenses. Set reminders and add Alimentor widgets to your Home Screen, Lock Screen, or desktop to stay on top of upcoming expenses. |

| Planned vs. Actual | Enter both expected and actual amounts and dates for any expense. Quickly spot discrepancies—such as underpayments, late payments, or missed reimbursements. |

| Reimbursements |

Track amounts owed to you or paid to the other parent. Log reimbursements as separate entries to ensure everyone’s contributions are clear and accountable.

iOS

Use the built‑in percentage calculator to easily create reimbursements

based on recorded expenses following percentages set by the court.

|

| Photo & PDF Attachments |

Attach receipts, invoices, payment confirmations, statements, contracts or other documents (PDFs/photos) to relevant records.

iOS

Use the built‑in document scanner to conveniently add scans of long receipts to your records.

|

| Hashtags |

Take advantage of hashtags (e.g., #medical, #childcare) for custom grouping and filtering—perfect for tailoring reports for legal, tax, or personal needs.

|

| Disagreement Flags | Mark entries with a disagreement flag if there’s a dispute over payment, amount, or responsibility—making issues easy to review. |

| Customizable Reports | Generate PDF summaries or journals of expenses. Use advanced text filters and custom section titles to tailor your reports for court, mediation, or tax purposes. |

| Export to Spreadsheet |

Export your data to Excel (.xlsx) for sharing with lawyers, accountants, or for advanced analysis and record-keeping.

|

| Last Modification Date Tracking | You can choose to show the last modification date for each record in your reports—providing extra credibility and transparency if needed for legal purposes. |

Expense records have several key fields. Here’s how to use them:

#Medical) to flag expenses for tax or other purposes. These tags become powerful filters when generating reports later on.

#CDCC hashtag (short for "Child and Dependent Care Credit") in the notes. Over the year, you’ll have 12 such records. When it’s time to file your taxes, you filter your Alimentor report by that hashtag or expense title—it will show the total amount you paid for the year (for example, $6,000), which you can then use on your tax form. If the IRS ever questions your credit, you have a neatly organized set of receipts and records for each payment. This level of documentation means you’re fully prepared to defend your claim and helps you double-check that you haven’t missed any payments when calculating your total credit.

One of Alimentor’s strengths is turning your data into readable reports that you can share or save for your records. The app’s built-in reports compile all expenses and other custody records into organized summaries. The key report sections relevant to expenses include:

You can customize many aspects of your reports.

Begin by selecting the reporting period, caregivers and children, record types, and sections you want to include.

For even more control and flexibility, use text filters and custom section titles.

For example, filter by a hashtag like #Dental and change "Custody Journal" to "Dental Treatment Log" to focus your report on dental-related records.

There’s also an option to export your entire dataset to a spreadsheet (.xlsx).

Exporting to Excel is especially helpful if you want to perform custom calculations or create charts that go beyond Alimentor’s built-in summaries.

The exported file is a true Excel document, with correct data types for each column (unlike basic .csv exports), so dates, numbers, and text are all accurately preserved. It’s also a convenient way to share your raw data with a financial planner or tax preparer who prefers working in Excel.

Keeping financial records might feel like a chore, but with Alimentor it becomes a constructive habit that truly pays off. By diligently logging child-related expenses, attaching receipts, and updating statuses, you’re building a credible record that can support you in negotiations, court hearings, and tax preparations. Just as importantly, you’re staying on top of your child’s needs and helping both parents remain accountable. It’s a positive step toward transparent, healthy co-parenting.

Want to give it a go? Open the app and enter something you’ve been meaning to document—maybe that last school supply run or the soccer registration fee. Try out a feature or two, like adding a photo of a receipt or tagging an entry for easy lookup later. As you explore Alimentor, you’ll find it not only easy to use but also empowering to have all these details at your fingertips. With each new record and reimbursement you log, you’re investing in a smoother co-parenting experience. Stay organized, stay prepared, and let Alimentor help you every step of the way. Happy tracking!

For a broader overview of the types of documentation courts look for in child custody cases—including parenting time calendars, custody journals, and supporting evidence—see our related guide: Documentation in Child Custody Cases ▶

If you have any questions about Alimentor, or want to share your feedback, please email us at: feedback@alimentor.org.